| Home Loans for Under Construction Properties | Best for |

| Bank of Baroda Home Loan | Home Buyers in Rural Areas |

| SBI Regular Home Loan | Special Rates for Women |

| PNB Housing Loan | Approved Projects |

| Canara Bank Home Loan | Longer Repayment |

| LIC Home Loan | Late Possession |

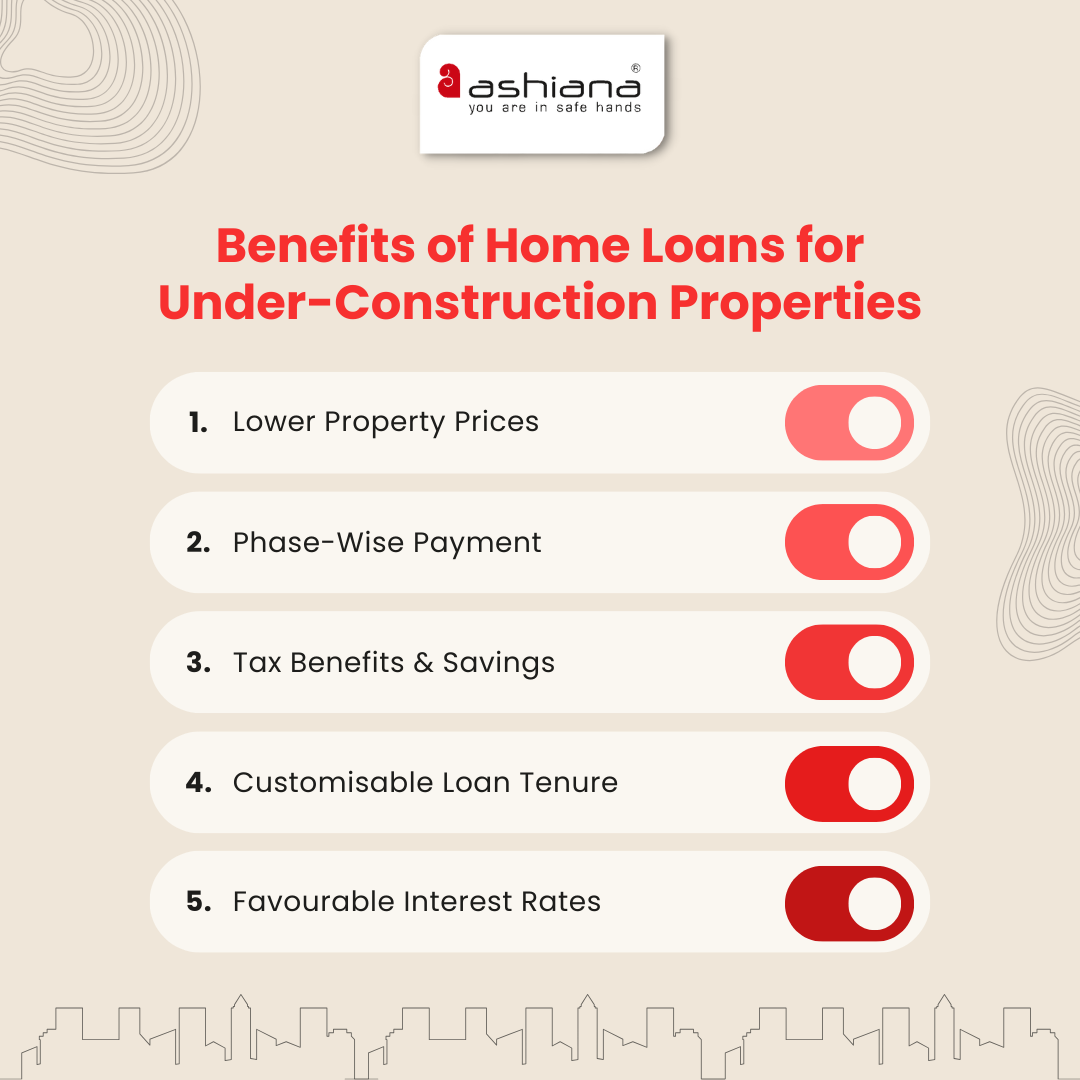

Yes, you can. When you take a home loan for an under-construction property, the bank or financial institution disburses the loan amount in installments as the construction progresses. Interest is charged only on the amount disbursed. As construction progresses, your EMIs increase proportionately until full disbursement.

Most developers offer flexible payment options for under-construction properties. Usually, the property can be booked by depositing 10% of the quoted property value.

For under-construction property, an individual can claim a deduction on the principal repayment, including stamp duty and registration fees, up to Rs. 1.5 lakhs under Section 80C after the construction is completed.

Ashiana, Ashiana Housing build homes. Homes surrounded by vast green spaces and fresh breeze. Homes cocooned in secured gated complexes. Homes where futures are forged and there are opportunities to grow. And Homes in environments brimming with healthy activity, trust and respect. At heart, we build communities with care.

Other posts by Ashiana

Join 1000+ of fellow readers. Get expert real estate knowledge straight to your inbox absolutely free. Just enter your email address below.