What Does BHK Mean? Understanding Real Estate Terminologies

April 4, 2025 Real Estate Premium Homes

The world of real estate is filled with unique terminologies and acronyms that can often leave first-time homebuyers or renters puzzled. Among these, the term “BHK” frequently pops up in property listings and conversations. Whether you’re searching for your dream home or considering an investment, understanding what BHK means is essential to making informed decisions.

Read More

Indoor Fitness Ideas for Seniors and Families

April 3, 2025 Retirement Homes Senior Living

Staying active is essential at any age. For seniors, regular movement can significantly enhance mobility, boost mental well-being, and improve overall health. However, outdoor workouts aren’t always feasible due to weather conditions, safety concerns, or personal preferences. This is where indoor fitness becomes a practical and enjoyable alternative. It offers a fun and effective approach for seniors to stay in...

Read More

How to Increase Bone Density After 60: Bone Health Tips for Seniors

April 1, 2025 Retirement Homes Senior Living

Aging brings many joys—wisdom, experience, and a treasure trove of memories. However, it also comes with some physical challenges, one of which is declining bone density. Weak bones increase the risk of fractures, limiting mobility and independence. The good news? You can strengthen your bones at any age, including after 60. Here’s how.

Read More

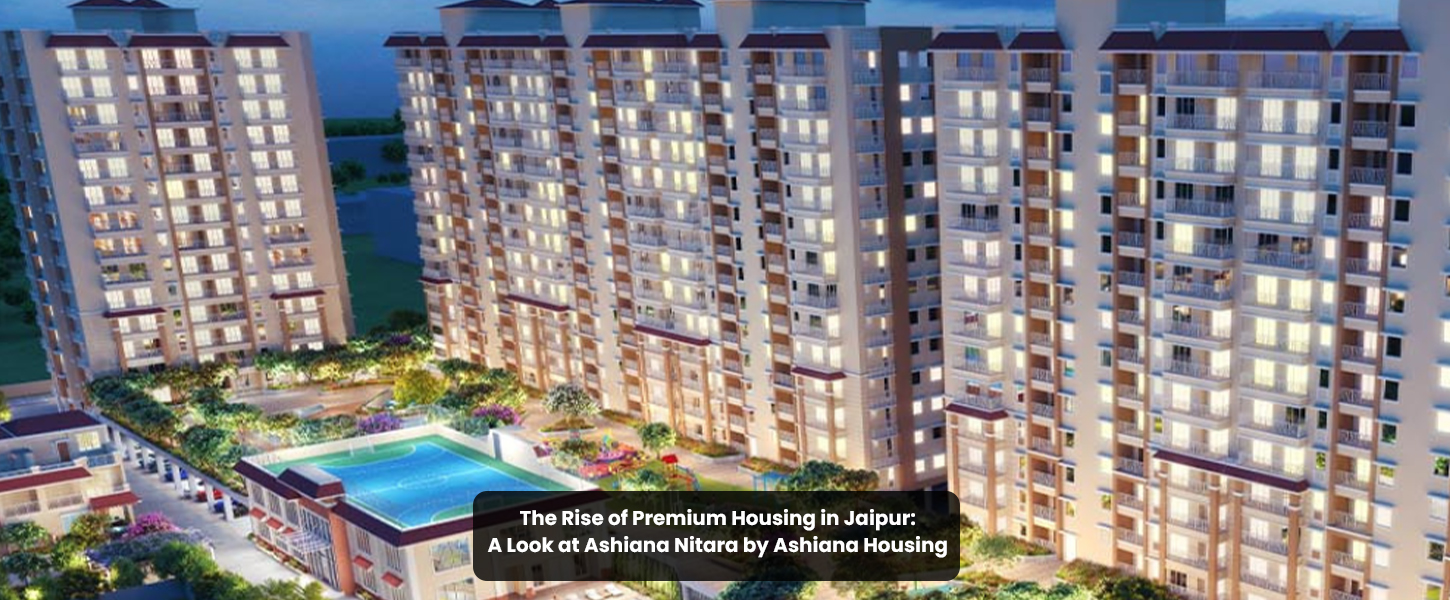

The Rise of Premium Housing in Jaipur: A Look at Ashiana Nitara by Ashiana Housing

March 27, 2025 Real Estate Premium Homes

Jaipur, popularly known as the Pink City, has always been a hub of rich cultural heritage and architectural brilliance. In recent years, the city has transformed into a thriving urban center with a growing demand for premium housing. Among the standout developments in Jaipur’s real estate landscape is Ashiana Nitara by Ashiana Housing, a name synonymous with trust and excellence...

Read More

Why Exercise Is Key for Adults with Parkinson’s and Alzheimer’s Disease

March 26, 2025 Retirement Homes Senior Living

Aging is a journey that brings wisdom, experience, and sometimes health challenges. Among these, neurodegenerative diseases like Parkinson’s and Alzheimer’s can significantly impact quality of life. While there’s no cure for these conditions, one powerful tool has been proven to slow their progression and improve daily living—exercise.

Read More

Chocolate and Children: Exploring the Emotional Bond, Health Perks, and Hidden Risks

March 26, 2025 Real Estate Kid Centric Homes

Chocolate holds a special place in children's hearts. From the joy of unwrapping a chocolate bar to the comforting taste that brings smiles, chocolate often becomes a cherished treat during childhood. However, as delightful as it may be, chocolate consumption has benefits and risks for children. Balancing this privilege with health considerations is essential for parents.

Read More

5 Ways to Keep Your Eyes Safe this Summer

March 25, 2025 Retirement Homes Senior Living

Summer is a season of vibrant sunshine, outdoor activities, and warm memories. However, with rising temperatures and harsh UV rays, our eyes often face challenges that go unnoticed. From dryness and irritation to serious conditions like conjunctivitis and sunburned eyes, the summer heat can take a significant toll on your eye health.

Read More

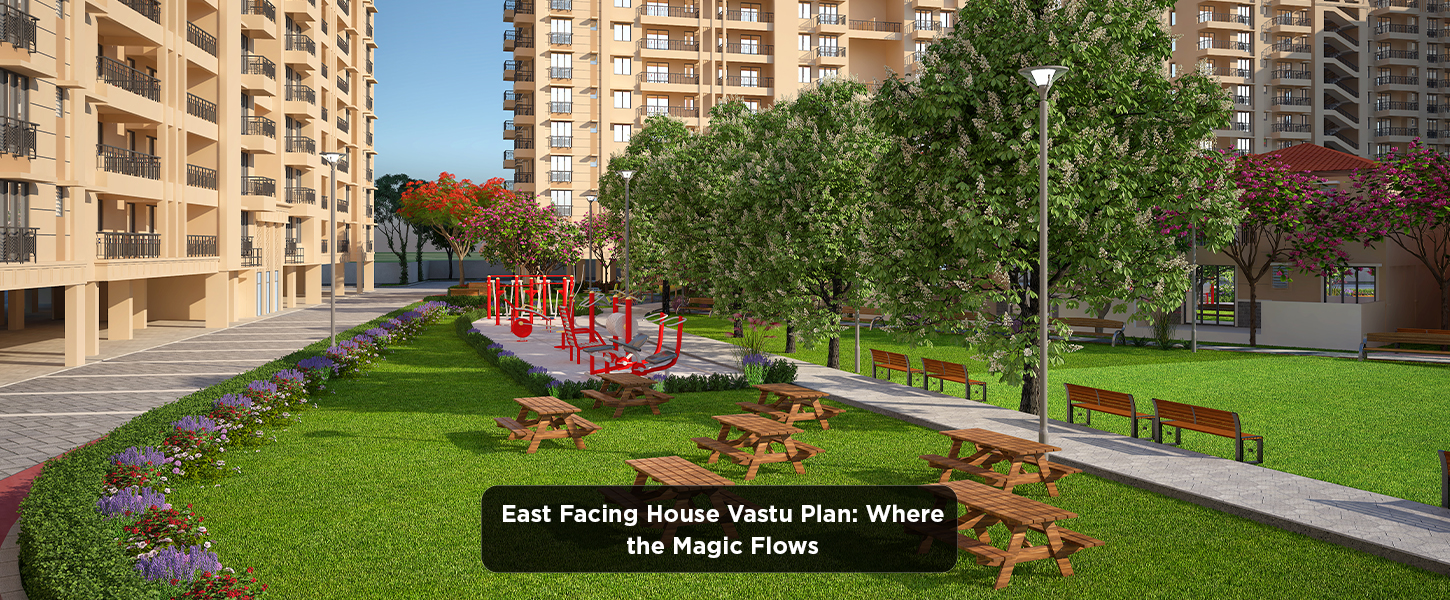

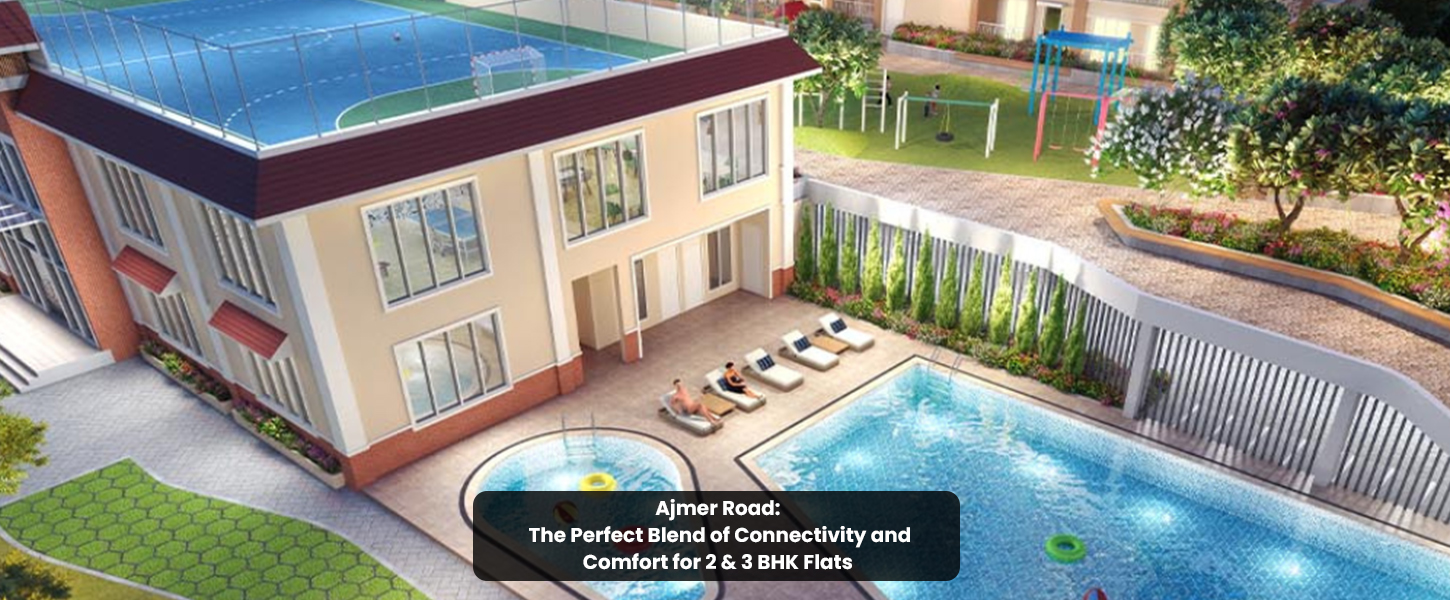

Ajmer Road: The Perfect Blend of Connectivity and Comfort for 2 & 3 BHK Flats

March 25, 2025 Real Estate Premium Homes

Ajmer Road in Jaipur has rapidly emerged as one of the most sought-after residential destinations in the city. This thriving locality is a harmonious blend of connectivity, modern amenities, and a serene environment—making it a hotspot for families, professionals, and investors looking for their dream homes. If you're considering purchasing a 2 or 3 BHK flat, Ajmer Road offers everything...

Read More

7 Home Gardening Tips for Seniors

March 24, 2025 Retirement Homes Senior Living

Gardening, more than just a hobby, is a therapeutic and rewarding experience that can significantly benefit seniors. Imagine stepping into a space where vibrant blooms and the gentle rustle of leaves create a sanctuary of calm. Perhaps you've gardened for years or, might even be new to gardening entirely, no matter your experience, we have tips for you. These tips...

Read More

10 Summer Reads for Seniors – Reviving The Young Self

March 22, 2025 Retirement Homes Senior Living

Summer is the perfect time to unwind with a good book, especially for seniors looking to revisit their youthful passions, relive nostalgic moments, and embrace new perspectives. Whether you love classic literature, inspirational biographies, or lighthearted fiction, the right book can transport you to another world.

Read More

Screen Time vs. Outdoor Play: What’s Better for Visual Perception Development?

March 22, 2025 Real Estate Kid Centric Homes

Visual perception is a foundational skill that plays a critical role in how children interact with the world. It is the ability to process and interpret visual information, helping children make sense of their surroundings, understand spatial relationships, and perform everyday tasks like reading, writing, and recognizing patterns.

Read More

Ajmer Road: Jaipur’s Top Destination for Affordable 2 and 3 BHK Flats

March 21, 2025 Real Estate Premium Homes