| Repo Rate | 6.50% |

| Reverse Repo Rate | 3.35% |

| Bank Rate | 50.15% |

| Marginal Standing Facility Rate | 6.75% |

| Period – Date Effective from | Repo Rates |

| 8th August 2024 | 6.50% |

| 7th June 2024 | 6.50% |

| 8th February 2024 | 6.50% |

| 8th December 2023 | 6.50% |

| 8th June 2023 | 6.50% |

| 8 February 2023 | 6.50% |

| 7 December 2022 | 6.25% |

| 30 September 2022 | 5.90% |

| 05 August 2022 | 5.40% |

| 08 June 2022 | 4.90% |

| May 2022 | 4.40% |

| 09 October 2020 | 4.00% |

| 06 August 2020 | 4.00% |

| 22 May 2020 | 4.00% |

| 27 March 2020 | 4.00% |

| 06 February 2020 | 5.00% |

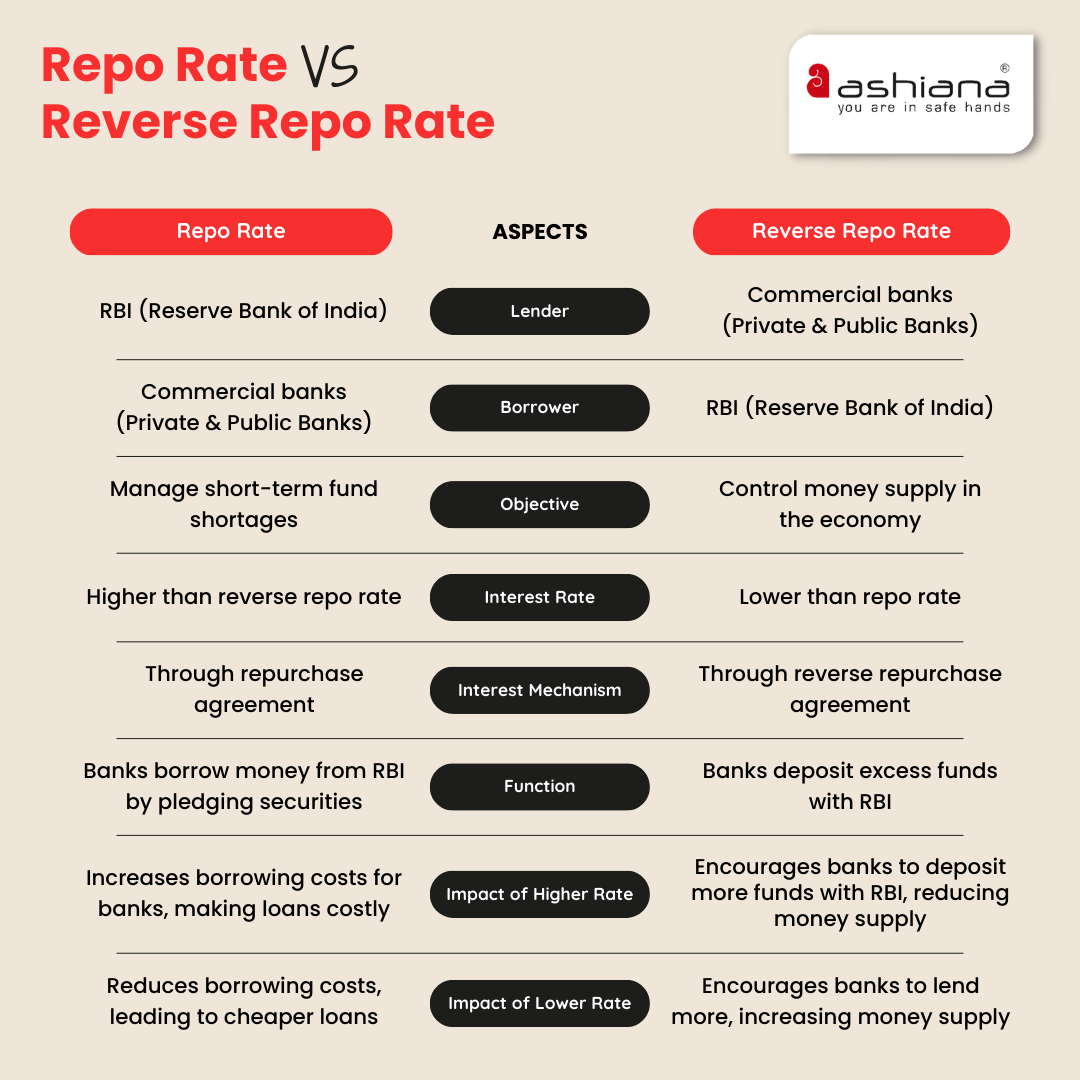

| Aspect | Repo Rate | Reverse Repo Rate |

| Lender | RBI (Reserve Bank of India) | Commercial banks (Private & Public Banks) |

| Borrower | Commercial banks (Private & Public Banks) | RBI (Reserve Bank of India) |

| Objective | Manage short-term fund shortages | Control the money supply in the economy |

| Interest Rate | Higher than reverse repo rate | Lower than the repo rate |

| Interest Mechanism | Through repurchase agreement | Through reverse repurchase agreement |

| Function | Banks borrow money from RBI by pledging securities | Banks deposit excess funds with the RBI |

| Impact of Higher Rate | Increases borrowing costs for banks, making loans costly | Encourages banks to deposit more funds with RBI, reducing money supply |

| Impact of Lower Rate | Reduces borrowing costs, leading to cheaper loans | Encourages banks to lend more, increasing money supply |

The current repo rate in India is 6.50%, as set by the Reserve Bank of India.

The current reverse repo rate in India is at 3.35%.

Yes, the repo rate directly impacts home loan interest rates. When the RBI raises the repo rate, borrowing costs for banks increase, leading to higher home loan rates for consumers, which can reduce housing demand. Conversely, a lower repo rate allows banks to offer cheaper home loans, making borrowing more affordable and potentially increasing demand for real estate.

A repo rate hike directly impacts loan EMIs by pushing up interest rates. This occurs because financial institutions, faced with higher borrowing costs from the RBI, pass on the burden to borrowers through increased loan interest rates.

Ashiana, Ashiana Housing build homes. Homes surrounded by vast green spaces and fresh breeze. Homes cocooned in secured gated complexes. Homes where futures are forged and there are opportunities to grow. And Homes in environments brimming with healthy activity, trust and respect. At heart, we build communities with care.

Other posts by Ashiana

Join 1000+ of fellow readers. Get expert real estate knowledge straight to your inbox absolutely free. Just enter your email address below.