Source: Homebazaar.com

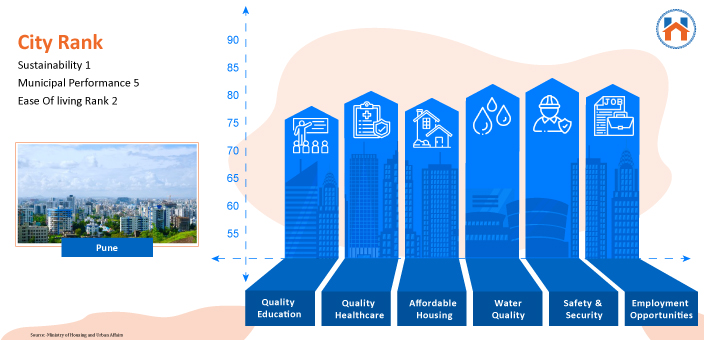

Also referred to as the “Oxford of the East”, the city demonstrates how NRIs could achieve great return on investment by investing in the Pune real estate market. Here are six interesting facts that might make NRIs furthermore keen on investing in the Pune real estate sector:

Source: Homebazaar.com

Also referred to as the “Oxford of the East”, the city demonstrates how NRIs could achieve great return on investment by investing in the Pune real estate market. Here are six interesting facts that might make NRIs furthermore keen on investing in the Pune real estate sector:

1. NRIs can invest in residential and commercial properties but not directly invest in agricultural land, farmhouses, or plantation property.

2. The NRIs can own an unlimited number of residential properties in India and the maximum limit interest on the loan taken for the purchase of the property is exempted under Sec 24 and Sec 80 C of the Income Tax Act, 1961.

3. NRIs can get home loans through an NRI account to buy properties. The RBI controls the use of the Indian currency and expects NRIs to pay 20 percent of the loan amount through owned money while the rest can be paid through borrowed money.

1. Documents: NRIs must submit an Indian passport and visa copy, work permit, recent income tax returns, and payslips for the last six months.

2. Special Power of Attorney: Granting Power of Attorney allows someone in India to handle your property transactions. Ensure the PoA document is notarized to avoid complications.

3. NRE and NRO Accounts: NRIs should maintain NRE and NRO accounts. The NRE account allows tax-free foreign income transfers, while the NRO account manages Indian income sources.

Ashiana, Ashiana Housing build homes. Homes surrounded by vast green spaces and fresh breeze. Homes cocooned in secured gated complexes. Homes where futures are forged and there are opportunities to grow. And Homes in environments brimming with healthy activity, trust and respect. At heart, we build communities with care.

Other posts by Ashiana

Join 1000+ of fellow readers. Get expert real estate knowledge straight to your inbox absolutely free. Just enter your email address below.